Why Joining a Federal Cooperative Credit Union Is a Smart Choice

Signing Up With a Federal Credit Union stands for a critical economic step with many advantages that accommodate people seeking an extra community-oriented and tailored banking experience. The allure of reduced charges, competitive prices, and outstanding customer solution sets credit scores unions apart in the financial landscape. Yet beyond these benefits lies a much deeper commitment to member satisfaction and area support that establishes them apart. By discovering the distinct offerings of Federal Cooperative credit union, people can take advantage of a globe of monetary empowerment and connection that exceeds traditional financial solutions.

Reduced Fees and Competitive Rates

Furthermore, federal lending institution typically give much more affordable rates of interest on interest-bearing accounts and car loans contrasted to traditional banks. By focusing on the financial well-being of their participants, lending institution can use greater rates of interest on savings products, assisting people expand their money faster. On the borrowing side, lending institution tend to have lower rate of interest on finances, consisting of home mortgages, auto fundings, and individual financings, making it more cost effective for members to accessibility credit when required. Joining a federal cooperative credit union can thus cause considerable expense financial savings and economic advantages for people looking for a much more member-centric banking experience.

Focus on Participant Fulfillment

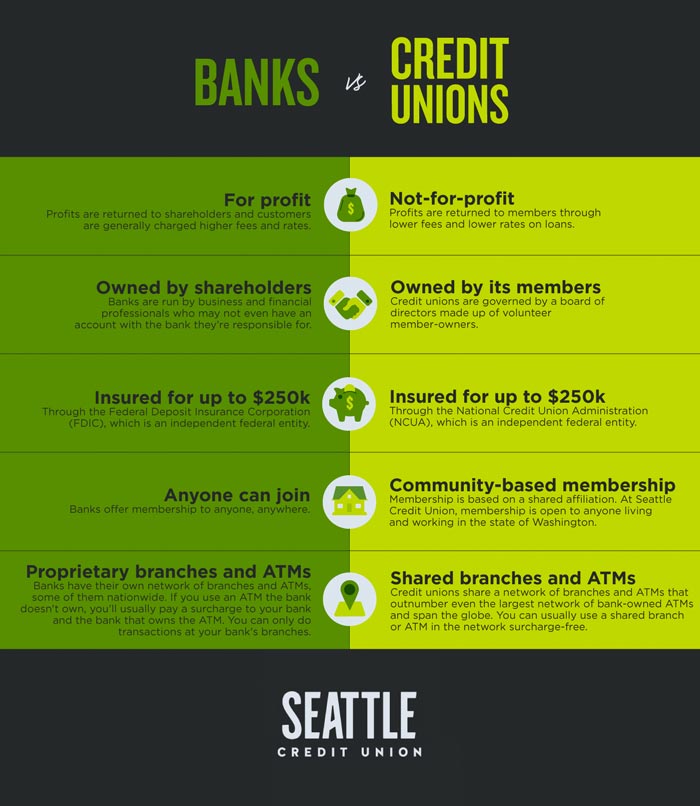

Federal credit history unions focus on member fulfillment by customizing their monetary products and services to meet the unique needs and choices of their participants. Unlike standard financial institutions, government credit rating unions operate as not-for-profit companies, permitting them to concentrate on offering outstanding service to their participants instead than optimizing revenues.

Moreover, federal lending institution usually use reduced rate of interest on fundings, higher interest rates on interest-bearing accounts, and minimized fees compared to large banks. By maintaining the very best interests of their participants in mind, credit report unions produce a much more fulfilling and positive financial experience. This commitment to participant fulfillment fosters solid relationships in between credit score unions and their members, bring about long-lasting commitment and depend on. By picking to join a government lending institution, individuals can benefit from a banks that absolutely cares about their health and economic success (Cheyenne Credit Unions).

Community-Oriented Approach

Stressing area interaction and local influence, federal cooperative credit union demonstrate a commitment to offering the needs of their bordering communities. Unlike traditional financial institutions, federal lending institution run as not-for-profit organizations, allowing them to concentrate on benefiting their areas and members as opposed to optimizing profits. This community-oriented strategy is apparent in numerous elements of their procedures.

Federal cooperative credit union often focus on offering monetary solutions tailored to the certain needs of the regional area. By understanding the special challenges and chances present in your area they serve, these credit unions can supply even more accessible and customized economic solutions. This targeted strategy fosters a feeling of belonging and trust fund among community members, enhancing the bond in between the lending institution and its components.

In addition, federal cooperative credit union frequently participate in neighborhood advancement efforts, such as sustaining regional services, funding occasions, and advertising economic proficiency programs. These initiatives not just add to the financial development and security of the neighborhood yet likewise show the debt union's devotion to making a favorable influence past simply monetary solutions. By actively taking part in community-oriented activities, federal cooperative credit union establish themselves as columns of assistance and campaigning for within their communities.

Accessibility to Financial Education

With a concentrate on empowering members with crucial financial understanding and abilities, federal debt unions prioritize giving easily accessible and comprehensive monetary education programs. These programs are created to furnish members with the tools they need to make enlightened choices about their financial resources, such as budgeting, conserving, spending, and credit scores administration. By supplying workshops, workshops, on-line sources, and one-on-one counseling, federal cooperative credit union make certain that their participants have accessibility to a vast array of educational opportunities.

Financial education is important in aiding people browse the intricacies of personal financing and accomplish their long-lasting monetary goals. Federal lending institution recognize the value of monetary literacy in promoting financial well-being and stability amongst their participants. By using these academic resources, they empower people to take control of their economic futures and develop a strong foundation for financial success.

Enhanced Client Service

Prioritizing extraordinary member care is indispensable to cultivating strong relationships and commitment within cooperative credit union - Cheyenne Credit Unions. Improved customer care is a characteristic of government cooperative credit union, setting them apart from typical banks. Participants of government credit scores unions frequently experience a greater level of personalized service, as these institutions focus on individualized focus and support. Whether it's aiding with account management, giving monetary suggestions, or attending to concerns immediately, federal cooperative credit union aim to go beyond member expectations.

One key element of boosted client service in federal credit score unions is the emphasis on building long-lasting connections with participants. By taking the time to understand participants' economic objectives and supplying tailored solutions, lending institution can Cheyenne Credit Unions give purposeful assistance that goes past transactional communications. Additionally, government lending institution usually have a strong neighborhood emphasis, additional improving the level of client service by fostering a sense of belonging and connection amongst participants.

Verdict

To conclude, signing up with a Federal Credit scores Union provides various benefits such as reduced costs, affordable rates, customized service, and accessibility to economic education and learning (Credit Unions Cheyenne). With a concentrate on member satisfaction and neighborhood involvement, cooperative credit union focus on the monetary wellness of their participants. By choosing to be component of a Federal Lending institution, people can enjoy a customer-centric approach to banking that fosters strong neighborhood links and encourages them to make enlightened financial choices

On the borrowing side, credit report unions tend to have lower passion prices on financings, including home loans, car loans, and individual lendings, making it extra affordable for members to access credit rating when required.Federal credit scores unions focus on member fulfillment by customizing their financial items and solutions to meet the one-of-a-kind needs and preferences of their participants.With an emphasis on empowering participants with important monetary expertise and skills, federal debt unions prioritize supplying detailed and obtainable financial education programs. Federal credit score unions understand the significance of monetary proficiency in advertising economic well-being and stability among their members. With a focus on member fulfillment and area involvement, credit scores unions prioritize the monetary wellness of their participants.